First and foremost, the global economy faces unprecedented volatility and uncertainty. Geopolitical tensions, trade disputes, and the lingering effects of the COVID-19 pandemic have created a highly unpredictable environment for financial markets. In such circumstances, investors seek liquidity and flexibility to adapt to rapidly changing conditions. By selling gold and jewelry, individuals can unlock cash reserves that can be deployed strategically to take advantage of emerging opportunities or to bolster their financial security.

Furthermore, the traditional narrative of gold as a hedge against inflation may not hold as much weight in the current economic landscape. While inflationary pressures have indeed been on the rise in recent months, central banks have signaled their willingness to take action to prevent runaway inflation. This proactive stance, coupled with advancements in monetary policy tools, has tempered concerns about hyperinflation and diminished the perceived necessity of holding large quantities of gold as a hedge.

Additionally, the opportunity cost of holding onto gold, diamonds, and jewelry has increased in an environment where alternative investment opportunities offer potentially higher returns. With interest rates at historic lows and equity markets exhibiting resilience despite periodic downturns, investors may find better prospects for growth and income generation in other asset classes. By divesting from gold and jewelry, individuals can reallocate their capital towards investments with greater potential for capital appreciation and income generation over the long term.

Moreover, the proliferation of digital assets and cryptocurrencies has introduced a new dimension to the investment landscape, challenging the dominance of traditional stores of value like gold. While gold has historically served as a reliable hedge against currency depreciation, cryptocurrencies offer decentralized, borderless alternatives that resonate with younger generations and tech-savvy investors. As digital assets continue to gain mainstream acceptance and adoption, the appeal of gold and jewelry as investment vehicles may diminish further, making it opportune to sell these assets before their value depreciates.

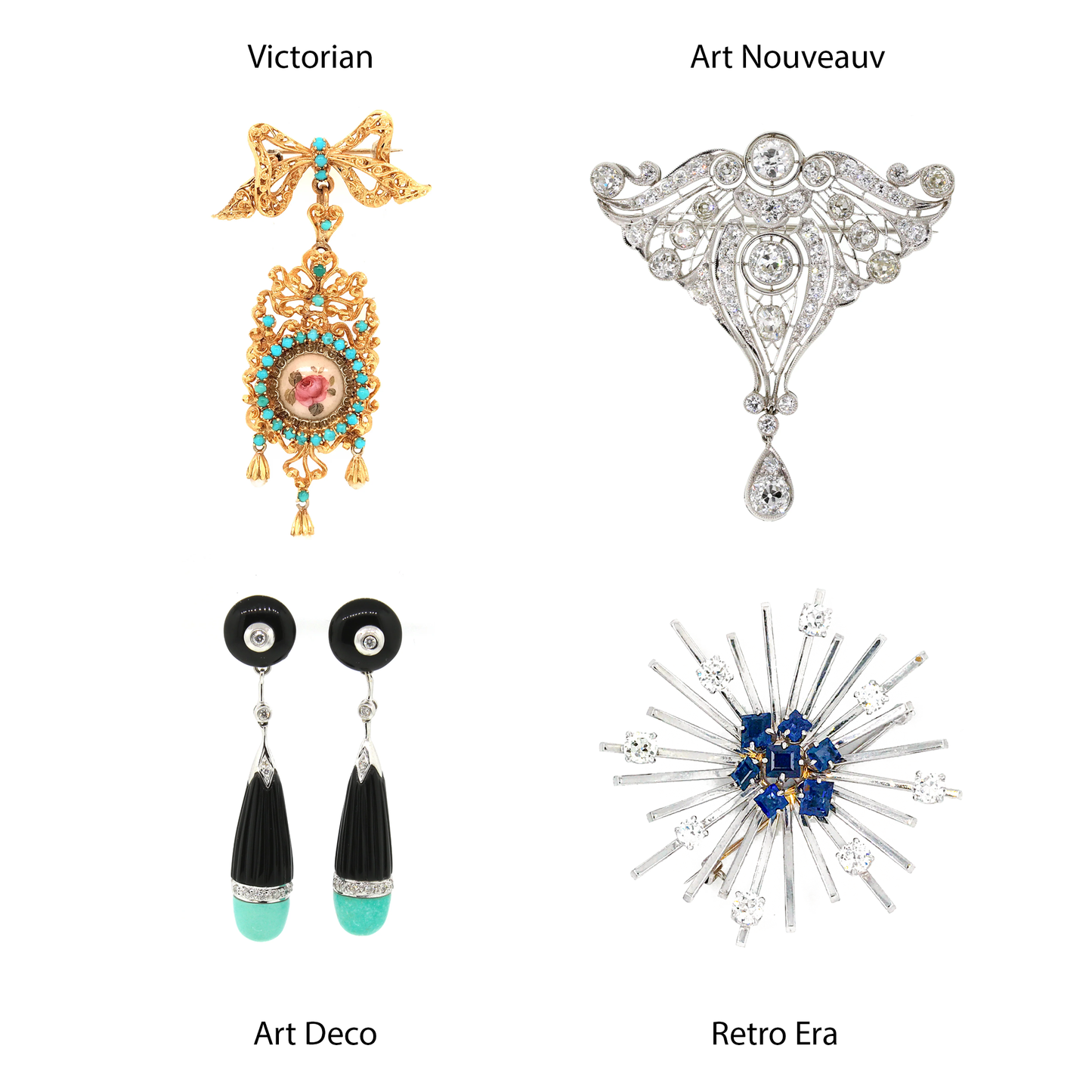

In conclusion, the current economic climate presents compelling reasons for individuals to consider selling their gold, gems, and fine jewelry. The combination of heightened volatility, evolving monetary policies, and emerging investment opportunities underscores the importance of reassessing traditional investment strategies. By liquidating gold and jewelry holdings, investors can access liquidity, capitalize on alternative investment opportunities, and adapt to the changing dynamics of the global economy. While gold and jewelry have served as stalwart assets in times of uncertainty, the prudent investor must recognize when to pivot towards more agile and opportunistic strategies to safeguard and grow their wealth.

Andrew Fabrikant